Rising Prices Drive Surge in Albanian Business Deposits In 2023, business bank deposits in Albania experienced significant growth. Data from the Bank of Albania reveals that by the end of the year, business deposits in banks had reached a record 360 billion ALL, marking a 15.5% increase compared to the previous year. This surge in business deposits has … Read More

Notice Regarding the Option for Tax Bracket Review by the General Directorate of Taxes

Notice Regarding the Option for Tax Bracket Review by the General Directorate of Taxes The GDT emphasizes that the calculation of preliminary tax installments for the year 2024, particularly for professional services, is based on a percentage of the self-declared profits for the year 2023. As 2024 marks the initial implementation year of the new tax law, these … Read More

Anticipated Access to SEPA Set to Lower International Transfer Costs in Albania

Anticipated Access to SEPA Set to Lower International Transfer Costs in Albania Entering the Single Euro Payments Area (SEPA) is anticipated to lead to a notable reduction in the costs associated with international transfers. This move holds considerable promise for streamlining financial transactions across borders, offering lower expenses and faster processing times. Albania’s forthcoming membership in SEPA is … Read More

The Impact of High Taxes on Free Professions and the Role of Financial Consultation

The Impact of High Taxes on Free Professions and the Role of Financial Consultation The recent implementation of income tax laws for self-employed professionals in Albania has sparked concerns and raised significant challenges, particularly for liberal professions such as psychologists and lawyers. The tax burden imposed by these laws has been described as excessively high, with professionals … Read More

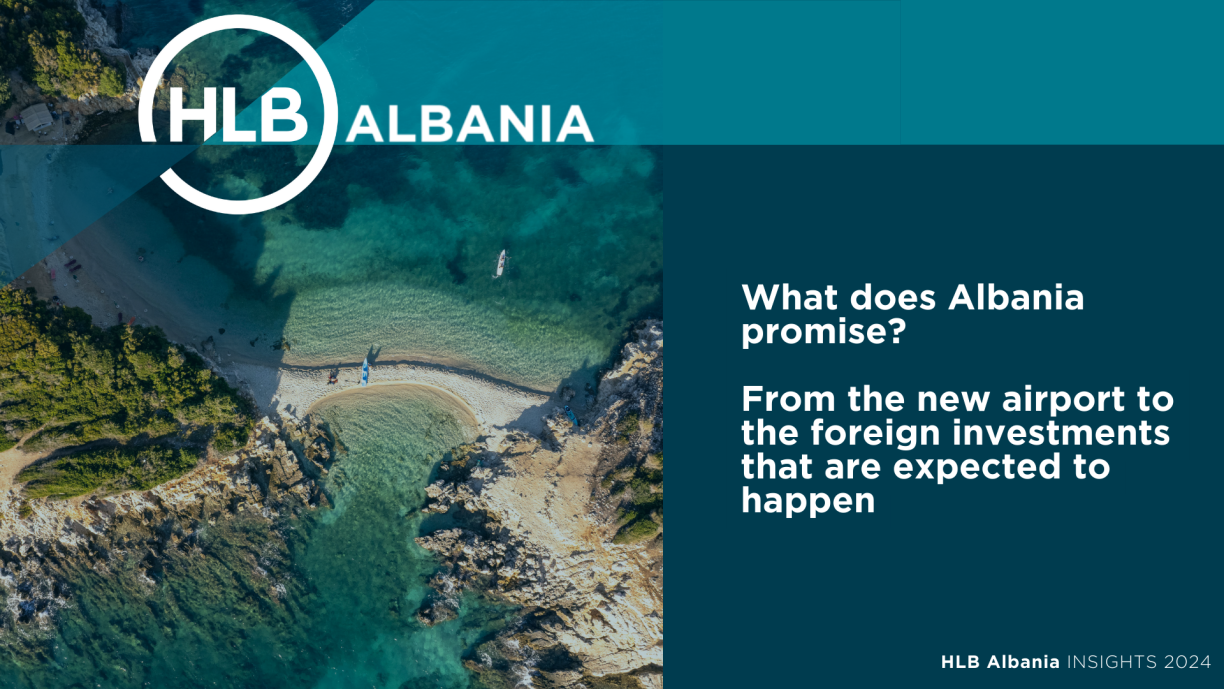

What you need to know about Albania: Investing in the country according to Total Impact

What you need to know about Albania: Investing in the country according to Total Impact 2023 marked a significant milestone for Albania, solidifying its position among Europe’s top destinations. Visitors who previously overlooked the country in their Balkan travels have now discovered its allure, from stunning beaches and majestic Alps to affordable prices and delicious cuisine. Media … Read More

Tender published for Italian migrant centres in Albania

Tender published for Italian migrant centres in Albania In a recent development, the Rome prefect’s department has announced tenders for the establishment of three Italian migrant centers in Albania, as part of an agreement between Rome and Tirana forged last year. The notification outlines the allocation of funds, with an annual budget of nearly 34 million euros … Read More

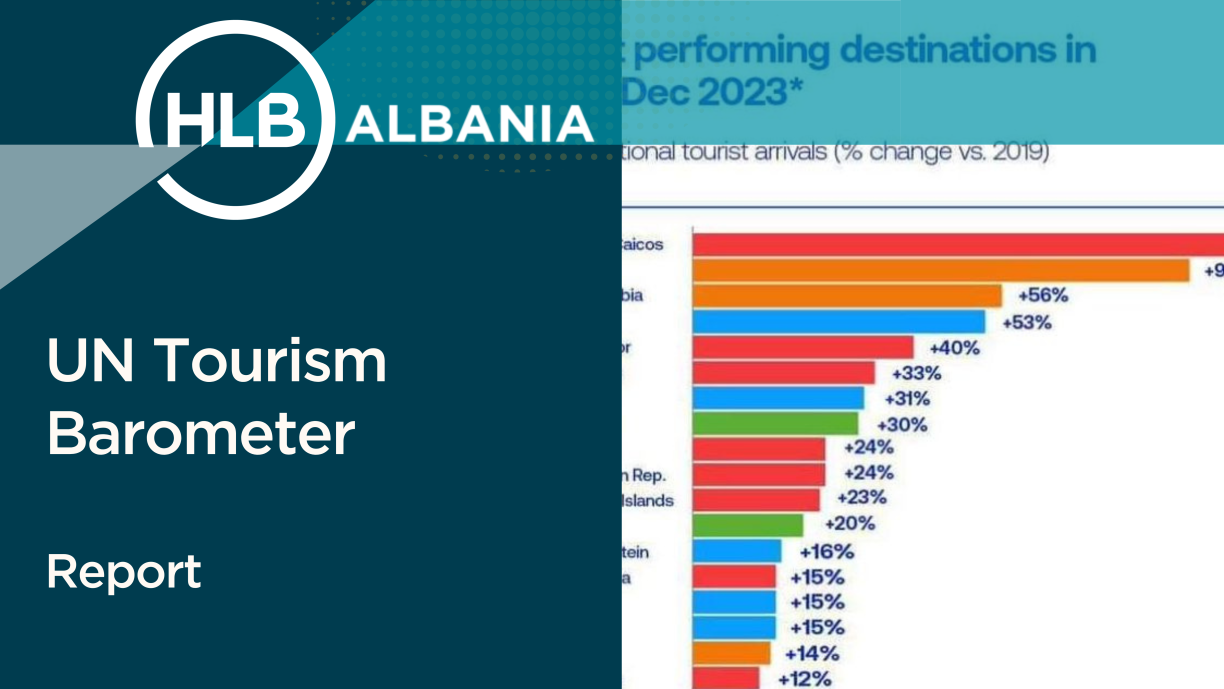

UN Tourism Barometer/ Albania Best Destination in Europe 2023

UN Tourism Barometer/ Albania Best Destination in Europe 2023 The UN Tourism Barometer, known for its regular monitoring of short-term tourism trends and providing timely analysis to global tourism stakeholders, has named Albania as the leading destination in Europe for 2023. Published quarterly, the Barometer offers insights into inbound tourism to destinations and outbound tourism from source … Read More

Economic Renaissance: A New Chapter in Albania

Economic Renaissance: A New Chapter in Albania In recent years, Albania, a country once shrouded in mystery and isolation, has embarked on a transformative journey, capturing the attention of the global community. With its stunning Adriatic coastline, rich historical tapestry, and vibrant culture, Albania is rapidly emerging as a beacon of progress and innovation in the Balkans. … Read More

Tax on Transfer of Real Estate in Albania

Tax on Transfer of Real Estate in Albania The Ministry of Finance and the State Cadaster Agency have recently issued a significant joint instruction titled “On Income Tax from the Transfer of Real Estate,” officially published on January 17, 2024. This instruction aims to clarify the application of capital gains tax from real estate transactions, particularly focusing … Read More

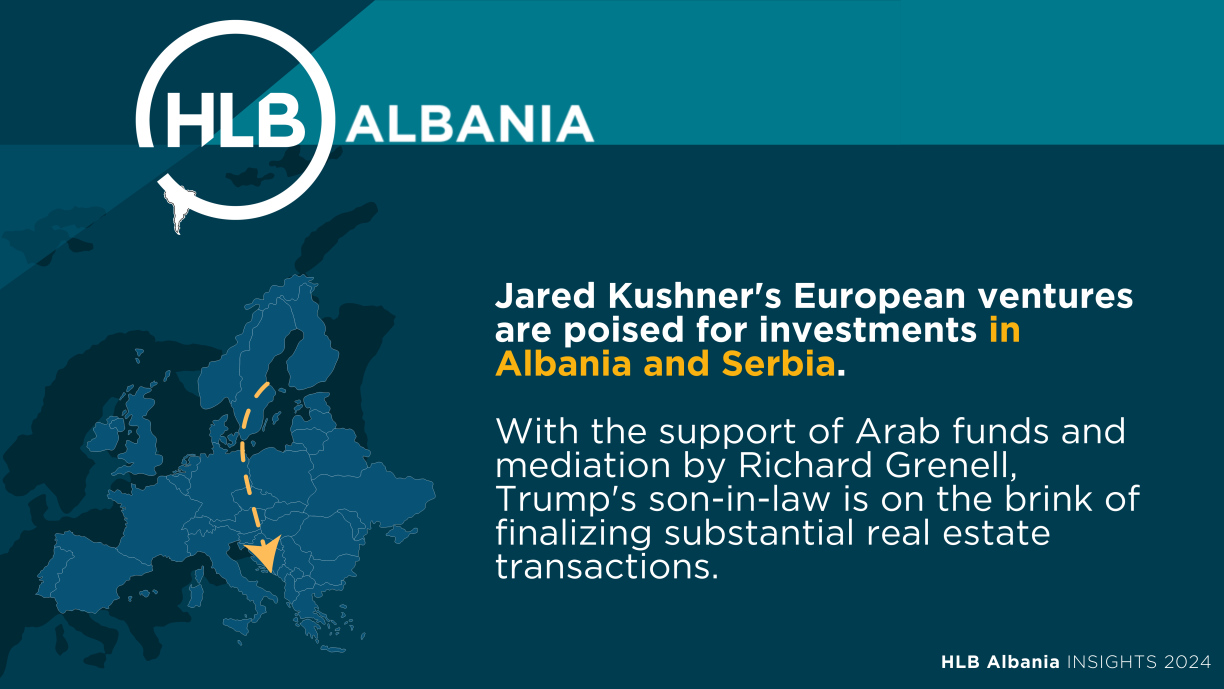

Jared Kushner Roars in Europe: Investing in Albania and Serbia with Arab Funds, Guided by Richard Grenell

Jared Kushner Roars in Europe: Investing in Albania and Serbia with Arab Funds, Guided by Richard Grenell Jared Kushner, son-in-law of former President Donald Trump, is on the cusp of finalizing substantial real estate deals in Europe, focusing primarily on Albania. Reports from The New York Times indicate that Mr. Kushner’s plans in the Balkans have gained … Read More